How Ag Lending Is Transforming With Earth Observation and Geospatial Analytics

Today’s farm operations are becoming bigger and bigger — but while farmers are farming more land, they aren’t necessarily owning more land. Instead, farmers are increasingly leasing the land, or portions thereof, that they farm.

When it comes to ag lending, this trend is creating both a challenge and an opportunity. With larger operations, farmers require additional capital, but the traditional debt-to-asset ratio constraints of asset-based lending make it difficult for them to access the cash they need each year.

To help ag lenders serve more customers while also minimizing risk, a viable solution lies in production-based lending. Unlike traditional lending, production-based lending depends less on farmers’ assets for collateral and instead relies on the value of their forthcoming crop yields to secure loans.

Money is born soil in the bottom of the plantations. Agribusiness profit land value and agricultural startups.

How production-based lending works

While production-based lending is emerging in the U.S., it has been used for decades in other parts of the world, such as Brazil. Under production-based lending, a farmer’s potential crop output is treated as an asset and part of the collateral they can contribute to secure their loan. It’s based on the concept that a farmer’s crop is as much an asset as the land it’s being grown on.

The historical challenge with production-based lending, though, is that it requires active crop monitoring in case of potential threats to the collateral — i.e., the crop. What’s more, traditional methods of crop monitoring are insufficient, rendering the loans beyond an acceptable risk threshold.

Traditional methods of crop monitoring often involve physically deploying staff members to walk the field or fly drones to inspect the crops in question, resulting in a time-consuming, expensive, subjective and inefficient process. As an alternative, some lenders rely on weather models, although this method has its drawbacks, as well. Weather monitoring doesn’t actually monitor the crops directly — it only makes assumptions about crops’ most likely condition based on environmental factors, leaving a wide margin for error.

How lenders are saving time and money with nontraditional crop monitoring

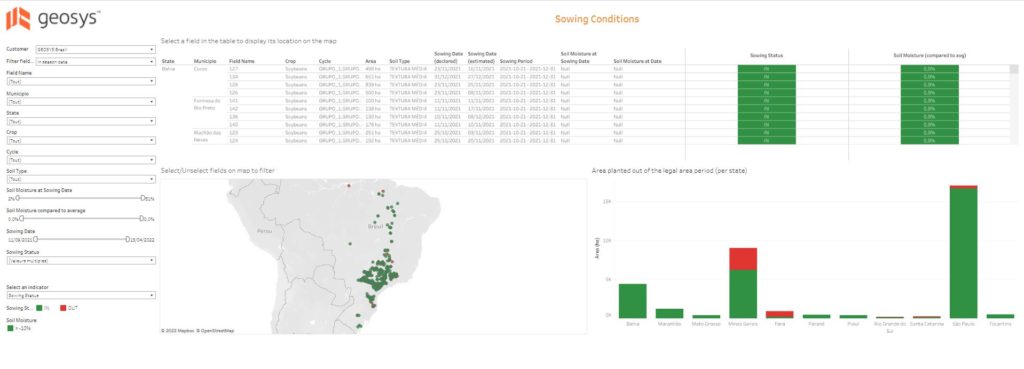

Earth Observation solves many of the challenges of traditional crop monitoring methods. With a partner like EarthDaily Agro, it becomes possible to confidently evaluate loan applications and monitor crop progress and take proactive action as needed, minimizing risk in production-based lending and helping lenders expand business opportunities.

EarthDaily Agro’s constellation of satellites orbit the Earth on a daily basis, capturing imagery and data of the planet’s surface. Through powerful software, this imagery and data is analyzed to obtain near real-time, ground-level data on environmental conditions, crop health and more. What’s more, historical data allows lenders to analyze the risk of growing a specific crop and know what to expect. Using this data, agribusinesses including lenders can make more informed, more confident business decisions.

Land plot in aerial view. Identify registration symbol of vacant area for map. That property, real estate for business of home, house or residential i.e. construction, development, sale, rent, buy, purchase or investment.

How Earth Observation supports lenders during each phase of the production-based lending process

Earth Observation helps ag lenders move faster, more efficiently and more confidently at every step of the process. During the pre-qualification phase, Earth Observation enables loan officers and brokers to process loan applications faster than competitors, helping them acquire more customers by being more nimble and agile. Using historical data on each farm field, Earth Observation can provide insights on likely outcomes for the current growing season based on algorithms and previous performance to predict risk.

Once a loan has been disbursed, Earth Observation allows lenders to monitor the recipient’s collateral — i.e., their crops —remotely, efficiently and with certainty. The technology allows lenders to confirm that the agreed-upon crop was indeed planted, that it was planted at the right time, that it is being properly tended to and more so that when it is ultimately harvested, lenders will achieve a return on their investment. Change detection technology keeps lenders informed throughout the growing season and can monitor for concerns such as drought, frost, excess water and more — including how crops are reacting to surrounding conditions.

Ultimately, Earth Observation increases business opportunities for lenders by expanding the geographies they are able to lend to. Traditional crop monitoring methods limit lenders’ customer footprints to nearby regions within travel distance, resulting in missed business opportunities. With Earth Observation, though, lenders can confidently and profitably issue loans to borrowers worldwide. EarthDaily Agro provides scientific-grade geospatial analytics globally — combining high-quality data with broad-scale coverage.

How to choose an Earth Observation partner

When it comes to Earth Observation providers, ag lenders have options. A number of Earth Observation providers offer either broad coverage, high frequency or quality data — but EarthDaily Agro combines all three. What’s more, EarthDaily Agro’s team of specialists has deep expertise in the agribusiness market with local agronomy experts across North America, South America and Europe.

To learn more about how geospatial analytics from EarthDaily Agro can make more possible for your business, contact our team.