Examining Global Wheat Supply Disruption Amid the Russia-Ukraine War

Today’s global food supply chain is highly connected and interdependent. As a result, it’s also sensitive to disruptions. Just how disrupted the market is by a given event, though, is a common question. And this is precisely the question at hand for organizations working in global food security.

When it comes to feeding the world, the current war in Ukraine has created a tangible disruption in the global food supply chain. Ukraine and Russia are among a group of countries that produce and export mainstay crops such as wheat, corn, barley, sunflower and rapeseed (a common sunflower oil substitute). And countries around the world — even those that don’t depend on Ukrainian and Russian crops — are experiencing ripple effects.

Disrupted agricultural production in Ukraine and Russia creates a gap in the global supply of these crops, putting extra responsibility on other producers around the world to try and make up the difference — and potentially resulting in shortages worldwide if they are unable to do so.

To help the world’s leading food security organizations make informed decisions, EarthDaily Analytics and its EarthDaily Agro agriculture division are harnessing the power of Earth Observation technology to actively monitor crop health around the world and detect early warning signs of production distress.

With global monitoring, it becomes possible to observe the ongoing changes of crop production to better understand the interdependencies of producers and importers of wheat, corn, barley, sunflower and rapeseed.

On an ongoing basis, EarthDaily Analytics will share regular crop health reports dedicated to each of the five major crops above whose global supplies may be most impacted by the war in Ukraine. In conducting this analysis, each report will categorize countries into three types:

- Major exporters: Countries that are major producers of the same crops as Ukraine. These are countries that may experience strain to fill gaps resulting from current market disruptions. Examples include China, India, the U.S., Canada, France and others.

- Dependent importers: Countries that rely heavily on crops grown in Ukraine and Russia. These are countries that may experience strain to boost their domestic production or imports in the wake of current market disruptions. Examples include Egypt, Indonesia, Bangladesh, Pakistan and others.

- At-risk developing nations: Countries already facing significant food security challenges. These are countries that, due to limited financial resources, may become particularly distressed by potential worldwide supply challenges.

Examining global wheat supply

Even before the war in Ukraine, the global food ecosystem was already under duress due to a combination of factors, including the pandemic, weather phenomena, as well as reduced production in Africa and Latin America. Now, the war has compounded the existing strain on the world’s food supply.

Our first crop reports in this series focus on wheat, including an Global Overview Report and Buyer Monitoring Report. When it comes to the effects of the war in Ukraine on the global wheat supply, satellite imagery suggests that two countries may be at particular risk as of today.

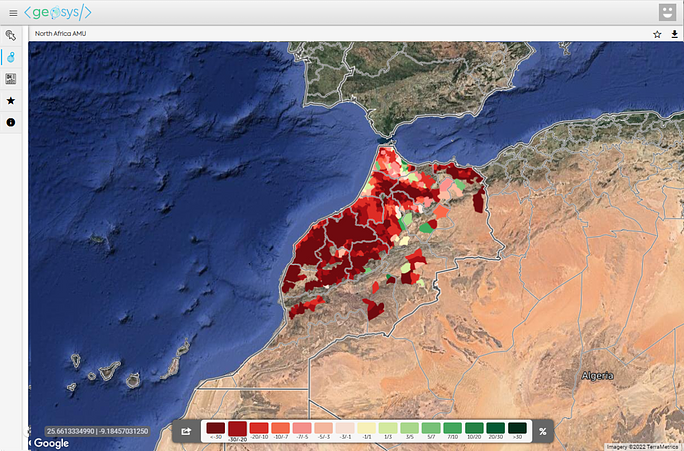

Effects to wheat supply in Morocco

Typically, Morocco produces 60% of the wheat its population consumes and imports the remaining 40% — 20% of which historically comes from Ukraine. Current growing conditions, however, suggest the country will experience heightened reliance on imports in 2022. Domestic wheat production in Morocco is currently at a five-year low, hindered in part by delayed precipitation in March.

Satellite data from EarthDaily Analytics finds that Moroccan crop health is currently severely compromised

While the country does source imported wheat from France as well as from Ukraine, recent dry weather in western Europe will likely reduce French exports significantly. Taking into account these challenges both to Morocco’s domestic production and to its import supply, the war in Ukraine stands to place heightened strain on Moroccan wheat availability.

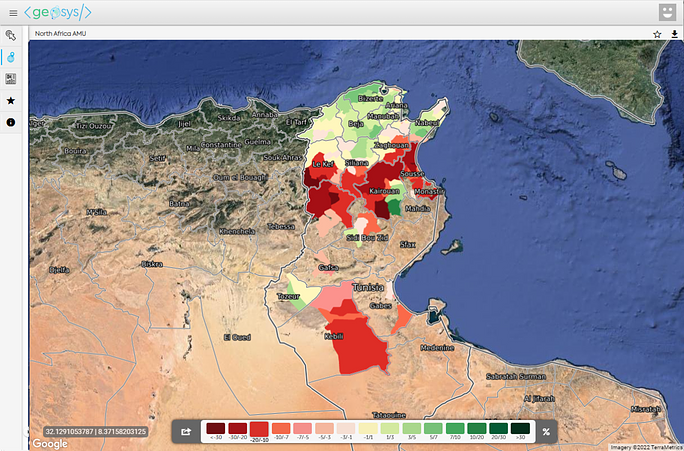

Effects to wheat supply in Tunisia

Tunisia, meanwhile, produces 41% of its wheat consumption, importing the remaining 59% — nearly half of which comes from Ukraine. While the country has experienced significant dryness recently, domestic crop health is currently pacing with historical averages. Close monitoring will be required to ensure the trend continues.

While Tunisia’s domestic wheat production is currently following historical averages, its heavy reliance on Ukrainian wheat exports may put the country at risk

Like Morocco, Tunisia also sources a portion of its imported wheat from France and will therefore also be affected by the reduced French exports currently anticipated. As a result, the country’s wheat supply will be particularly distressed by the supply issues stemming from the war.

Access the full report

EarthDaily Analytics is actively working with customers both inside and outside Ukraine to ensure they are maximizing their crop yields within the context of the anticipated global shortfalls that lend increased importance to each incremental unit of production.

Organizations interested in learning more are encouraged to access the full Global Overview Report and Buyer Monitoring Report. For additional information, contact EarthDaily Analytics. The next report in this series will be released on Friday, April 15.