How Ag Commodity Traders Can Stay Ahead of the Market

When you’re an agricultural commodity trader, every decision has a direct and immediate impact to your profitability. That’s a big risk to take on — at least, it is if you’re relying on traditional crop monitoring. With government agencies such as the USDA and Eurostat publishing their crop yield projections on a monthly basis, data sourced from these organizations can often be critically outdated.

And in a commodities market that moves at breakneck speed, old data can spell disaster. Time is money, after all, and when it comes to trading ag commodities, that truth is literal. Moving at or above the speed of the market takes data that moves equally fast. With each moment that your data’s delayed, your risk is only amplifying.

Every day, weather and world events change conditions in the field — conditions that will bear crucial influence over a given crop’s supply and demand on the open market. But if you’re reading a report that’s only released monthly, then your opportunity to act has already come and gone.

That’s why the most successful ag commodity traders harness insights in near real time to act fast in response to market volatility. And often, not only is the data they’re using more timely — it’s also more accurate.

Smart Trading Starts With Smart Insights

To get a leg up on the competition, ag commodity traders are increasingly turning to Earth Observation for around-the-clock monitoring of both their portfolios and the market at-large. A state-of-the-art form of business intelligence, Earth Observation employs specialized satellites that continuously monitor the Earth’s surface to detect changes including crop health — equipping ag commodity traders with near real time insights on events that will impact the market before their competitors catch on.

In particular, Earth Observation is valuable when conditions are volatile. Worldwide, the summer of 2022 has seen heatwaves and droughts across numerous regions — trends that have in many cases wreaked havoc on crop production, especially when it comes to corn. Relying on the USDA or Eurostat, you’d never know the full extent of the impact until it was too late.

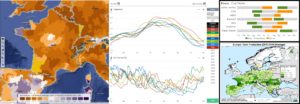

For example, as of mid-summer, the USDA’s current monthly report estimated European corn production at 68 million tonnes for the 2022 season. Meanwhile, Eurostat projected 72 million tonnes until July and recently they decreased to 66.1 MT. The trouble with these numbers, though, is that they didn’t reflect the influence of the most current conditions, making them hazardously misrepresentative. More timely calculations using Earth Observation revealed that Europe’s likely corn output would be significantly lower at 55.9 million tonnes.

As any ag commodity trader knows, the market implications of that kind of variance are significant. Expecting a certain level of supply and being met with a smaller amount means increased demand and increased competition — and with little to no time to prepare for it.

Data in Action: Real Insights From Earth Observation

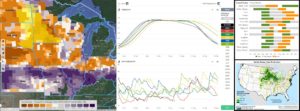

Using Earth Observation, though, ag commodity traders get to know more and know it faster. For example, the technology equipped corn traders in summer 2022 with insights including:

- United States: This season’s corn harvest will likely be noticeably below average. Low precipitation across the Corn Belt has impacted crop growth.

- France: French corn harvest is likewise in jeopardy. A combination of high temperatures and low soil moisture has made for dismal growing conditions.

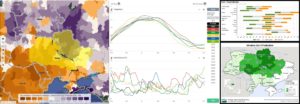

- Ukraine: While soil moisture in Ukraine has slowly improved over recent weeks, more rain is still needed.

The insights above come from EarthDaily Agro’s August 2022 Global Corn Overview Report and Global Corn Buying Report, part of an ongoing series of crop reports monitoring disruptions to the food supply chain amid the combined challenges of climate change, COVID-19 and Russia’s invasion of Ukraine.

How to Choose an Earth Observation Partner

When it comes to Earth Observation providers, ag commodity traders have options. A number of Earth Observation providers offer either broad coverage, high frequency or quality data — but EarthDaily Agro combines all three. What’s more, EarthDaily Agro’s team of specialists has deep expertise in the agribusiness market with local agronomy experts across North America, South America and Europe.

As an ag commodity trader, you’re only as good as your data. And with the power of Earth Observation, ag commodity traders can stop trying to catch up with the market and instead start being a driving force on the market. To learn more about how geospatial analytics from EarthDaily Agro can make more possible for your business, contact our team.

Access the Full Crop Reports now